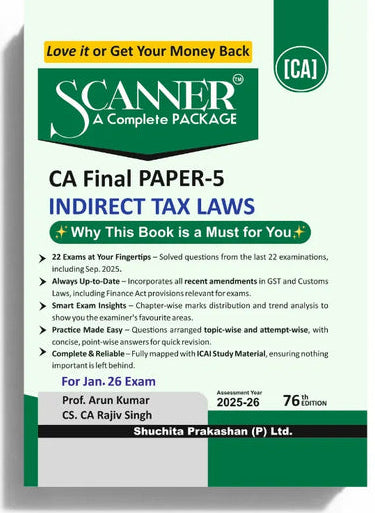

Shuchita Scanner CA Final Paper-5 Indirect Tax Laws Green Edition

- Rs. 354

Rs. 485- Rs. 354

- Unit price

- per

Product Information

xSubject |

Indirect Tax Laws |

Format |

Printed Books |

Faculty Name |

Prof. Arun Kumar, CA CS Rajiv Singh |

Course Material Language |

English |

Package Details |

76th Edition, Paperback book |

Item Code |

978-93-5586-605-9 |

Exams |

CA FINAL (2023 SCHEME) |

Exam Attempt |

Jan 2026 and Onwards |

Study Material Format |

Printed Books |

Delivery |

Home Delivery within 7-10 days from the date of Payment Confirmation. |

Brand |

Shuchita Prakashan |

Topics Covered |

Covering Complete Question Bank: More than last 20 examinations. Covering All topics as per Study Material. Relevant RTP Questions. Additional Practice Questions. |

Description

xKey Highlights:

✅ Covers ICAI content (Solved Questions from past 22 exams & including Question of Sep 2025)

✅ Topic- & Chapter-wise breakdown (mapped to ICAI study material)

✅ Updated solutions with latest amendments

✅ Chapter star ratings for focused prep

✅ Unique trend tools:

• Chapter-wise marks graph

• Compulsory question tracker

• Paper trend analysis (last 5 exams)

✅ Question-type classification:

• Compulsory • Short Notes • Descriptive • Practical

✅ Revision-friendly layout with progress tracker & QR codes for bonus content

Content Coverage:

• GST Law: CGST, SGST, IGST

• Levy, Exemption & Taxable Supply

• Time, Place & Value of Supply

• Input Tax Credit, Tax Invoice, Returns

• Job Work & E-Way Bill

• Refunds, Appeals, Offences & Penalties

• GST Audit & Assessment

• Customs Act, 1962

• Foreign Trade Policy (FTP)

• Search, Seizure, Arrest Procedures

• Ethics & Other Provisions and more…