Product Information

xFormat |

Printed Books |

Faculty Name |

Centax’s Editorial Board |

Course Material Language |

English |

Package Details |

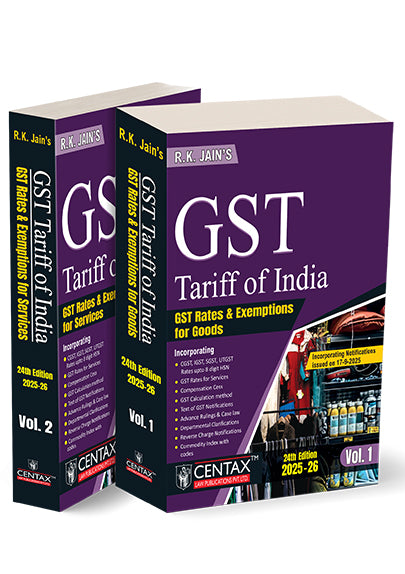

24th Edition October 2025, Paperback Book. |

Item Code |

9789349247086 |

Study Material Format |

Printed Books |

Delivery |

Home Delivery within 7-10 days from the date of Payment Confirmation. |

Brand |

Taxmann |

No of Pages |

2218 |

Description

xR.K. Jain's GST Tariff of India is a practice-ready, two-volume compendium that unifies rates, exemptions, classifications, notifications, clarifications, case law, advance rulings, and compensation cess across CGST, IGST, SGST and UTGST. It delivers the tariff for both goods (Chs. 1–98 + 98A) and services (Ch. 99 with SAC). Ready reckoners, reverse-charge tables, and an exhaustive Commodity Index with HSN codes make classification and rate discovery fast and defensible. A dedicated 'How to Calculate Tax under GST' section operationalises valuation and rate application.

This book is intended for the following audience:

- Indirect Tax Practitioners & Consultants handling classification, rate opinions, exemptions, advance rulings, and litigation support

- CFOs, Tax Heads, In-house GST Teams overseeing pricing, contracts, ITC optimisation, and compliance workflows

- Accountants, CAs, CMAs & CS Professionals preparing returns, audits, and assessments

- Advocates & Counsel requiring authoritative tariff integration with notifications, circulars, and case law

- Industry & Trade Associations needing a reliable reference for product/service classification and rate mapping

- Departmental Officers & Policy Professionals tracking Council decisions, compensations, and clarifications

The Present Publication is the 24th Edition | 2025-26, covering notifications issued on 17-09-2025. This book is edited by Centax's Editorial Board with the following noteworthy features:

- [HSN-integrated GST Tariff] Goods rates mapped up to 8-digit HSN, aligned with Customs Tariff Section/Chapter Notes and Interpretative Rules

- [Complete Services Coverage (Ch. 99)] SAC-wise rates, exemptions, Explanatory Notes, alphabetical and code-wise service lists

- [Ready Reckoners] Quick-reference tables for goods and services rates & exemptions, reverse charge, and compensation cess

- [Authoritative Primary Materials] Full texts of key CGST/IGST/UTGST/SGST notifications, nil-rated schedules, and exemption notifications

- [Council-linked Updates] Circulars & clarifications reflecting the 56th GST Council decisions

- [Computation Guidance] A six-step GST tax calculation method, including valuation inclusions/exclusions and a worked illustration

- [Cross-statute Visibility] Rates specified in other Acts (e.g., Central Excise components, NCCD, AIDC, Road & Infrastructure Cess) for holistic impact analysis

- [Litigation Support] Curated case law & advance rulings for classification and rate controversies

- [Research Efficiency] Commodity Index (HSN) and chronological notification list for back-tracking amendments and rate histories

The coverage of the book is as follows:

- Volume 1 — GST Rates & Exemptions for Goods

- Front Matter:

- How to Use this Tariff

- How to Calculate Tax under GST

- Introduction to GST Tariff

- Classification of Goods & Services

- Interpretative Rules (as applicable to GST)

- List of Abbreviations

- Part 1 — GST Tariff (Goods)

- Chapters 1–98 with CGST/SGST/UTGST/IGST rates up to 8-digit HSN; Chapter 98A covers miscellaneous/deemed supplies/actionable claims

- (Grey-box highlights flag entries where GST descriptions depart from HSN text or where multiple rates exist.)

- Part 1A — Rates specified in other Acts:

- Central Excise schedules (incl. NCCD, Special Addl. Excise Duty), tobacco & fuel duties, Road & Infrastructure Cess, AIDC, and Rule 18 (Rebate) extracts

- Part 2 — Goods Notifications

- CGST rate Schedules I–VII — Notification 9/2025-C.T. (Rate)

- Nil-rated goods — Notification 10/2025-C.T. (Rate)

- Miscellaneous exemptions

- Volume 2 — GST Rates & Exemptions for Services (including Allied Material)

- Part 3 — Services (Chapter 99):

- Ready Reckoner of rates/exemptions under CGST/SGST/UTGST/IGST with SAC

- CGST/IGST/UTGST-SGST notifications (services)

- Explanatory Notes to the Scheme of Classification of Services

- FAQs, circulars, instructions, press notes, case law, AARs (services & job work)

- SAC lists—code-wise and alphabetical

- Part 4 — IGST:

- Bird's-eye view of IGST

- Procedural notifications

- IGST rate/Exemption/Nil-rate notifications

- Part 5 — 56th GST Council:

- Circulars & clarifications implementing Council decisions

- Part 6 — Compensation Cess & other cesses:

- Compensation to States Act (extracts)

- Cess notifications & departmental clarifications

- Part 7 — RCM (Goods & Services):

- RCM notifications under CGST/IGST/UTGST/SGST with clarifications

- Part 8 — Commodity Index with HSN codes

- Part 9 — Chronological list of basic notifications

The structure of the book is as follows:

- Orientation & Method – Quick primers on using the tariff and calculating GST (valuation rules, rate discovery, cess, RCM), with a worked example for intra-/inter-State supplies

- Goods First, to 8-digit HSN – Chapter-wise entries with grey-box flags where GST entries depart from HSN wording or have multiple rate lines

- Services as Chapter 99 – SAC-based matrix with Explanatory Notes to prevent over- or under-classification

- Notifications Alongside Tariff – Schedules for rates, nil-rated, and exemptions printed in full, enabling primary-source validation

- RCM & Cess Segregated – Dedicated parts for reverse charge and compensation cess to avoid scattered look-ups

- Indexes – Commodity Index (HSN) plus alphabetical/code-wise service lists; chronological notification list for amendment tracking