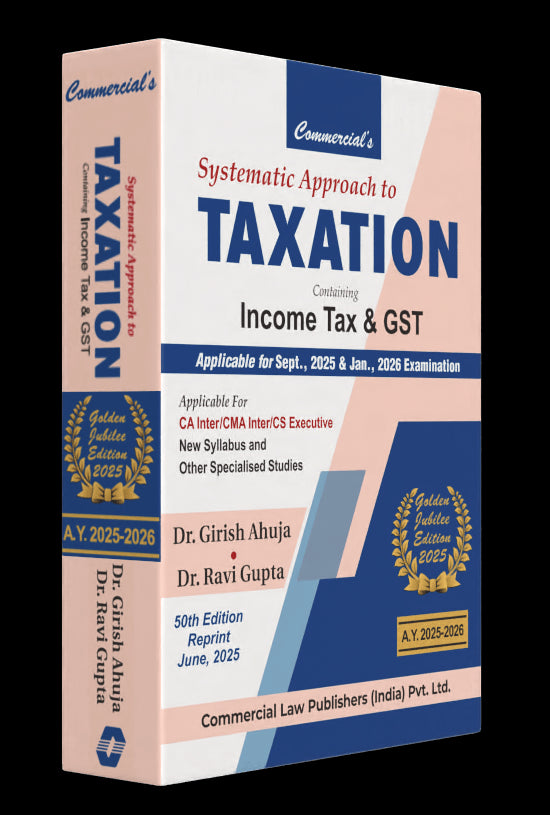

Commercial's Systematic Approach to Taxation Book for CA Inter by Dr Girish Ahuja, Dr Ravi Gupta

- Rs. 1,247

Rs. 1,599- Rs. 1,247

- Unit price

- per

Product Information

xSubject |

Taxation |

Format |

Printed Books |

Faculty Name |

Dr Girish Ahuja, Dr Ravi Gupta |

Course Material Language |

English |

Package Details |

50th Edition 2025, Paperback Book |

Item Code |

9789356037724 |

Exams |

CA INTERMEDIATE (2023 SCHEME) |

Exam Attempt |

Sep 2025 & Onwards |

Study Material Format |

Printed Books |

Delivery |

Home Delivery within 7-10 days from the date of Payment Confirmation. |

Brand |

Commercial Law Publication |

Description

xCommercial's Systematic Approach to Taxation Book for CA Inter by Dr Girish Ahuja, Dr Ravi Gupta

A Simplified approach to the understanding of a complex subject written in a unique, simple, easy to understand language that enables a quicker grasp for the student. The topics are explained with the help of Tabular and Graphical Presentation to make it simple for students to understand the concept.

Each topic after a theoretical exposition, is followed by plenty of illustrations with solution to facilitate the busy students to Master the practical application of the law. Numerous Problems and Solutions have been given to enable the students to clearly grasp the intricate provisions. There are more than 500 illustrations, Examples, Practical and Theoretical Question Which Help Students to Understand the Practical Aspects.

A Novel feature in the book is The Section-wise-study given in the beginning of each chapter to enable the students to make a systematic study of the law & User-Friendly Examination Oriented Style that facilities the comprehension in both section wise and topic wise manner.

MCQs and Practical Question of all the chapters are covered in "Systematic Approach to Taxation containing Income Tax and GST Multiple Choice Question (MCQs) Practical Question and Solved Questions Paper of Past Examination"

Even the last minute changes in the law have been incorporated in the book and it is therefore, the latest and most up to-date book for the assessment year 2024-2025. The amendment made by the Finance Act, 2023, have been incorporated at appropriate places in the book.

The Book is useful for the students appearing in CA-Inter and other specialized studies. It will also be useful for graduate/post graduate students of various Universities and Management Institutes as well as the departmental Examinations of the Income Tax Department.