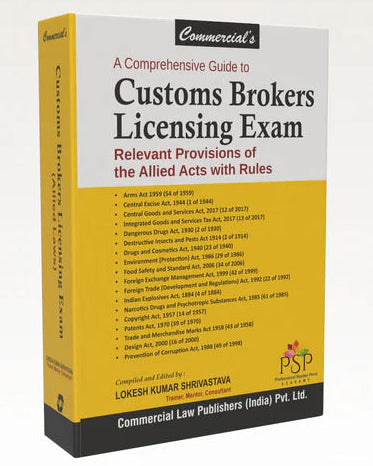

Commercial's A Comprehensive guide to Customs Brokers Licensing Exam Relevant Provisions of the Allied Acts with Rules

- Rs. 1,196

Rs. 1,595- Rs. 1,196

- Unit price

- per

Product Information

xFormat |

Printed Books |

Faculty Name |

Commercial law Publishers |

Course Material Language |

English |

Package Details |

2026 Edition, Paperback Book |

Item Code |

9789347218842 |

Study Material Format |

Printed Books |

Delivery |

Home Delivery within 7-10 days from the date of Payment Confirmation. |

Brand |

Commercial Law Publication |

Description

xThis comprehensive guide to the Customs Brokers Licensing Exam presents an authoritative and updated compilation of the relevant provisions of the Allied Acts along with their corresponding rules, making it an essential resource for candidates preparing for the examination as well as for practitioners engaged in customs, trade, and compliance work. Structured to provide clear access to the statutory frameworks that govern customs brokerage in India, the book brings together the bare text of multiple key legislations—precisely as enacted—ensuring accuracy, reliability, and suitability for examination and professional reference.

The content covers a wide spectrum of Acts and regulatory areas that intersect with customs operations, including:

• Arms Act, 1959

• Central Excise Act, 1944

• Central Goods and Services Tax Act, 2017

• Integrated Goods and Services Tax Act, 2017

• Dangerous Drugs Act, 1930

• Destructive Insects and Pests Act, 1914

• Drugs and Cosmetics Act, 1940

• Environment (Protection) Act, 1986

• Food Safety and Standards Act, 2006

• Foreign Exchange Management Act, 1999

• Foreign Trade (Development and Regulation) Act, 1992

• Indian Explosives Act, 1884

• Narcotics Drugs and Psychotropic Substances Act, 1985

• Copyright Act, 1957

• Patents Act, 1970

• Trade and Merchandise Marks Act, 1958

• Design Act, 2000

• Prevention of Corruption Act, 1988

By presenting these enactments in a consolidated form, the book enables readers to understand the legal environment surrounding customs brokerage, from trade controls and import–export regulations to narcotics laws, intellectual property protections, environmental safeguards, and taxation statutes. Each Act is reproduced in its authentic legislative format without commentary, ensuring that users engage directly with the exact provisions applicable for exam and compliance purposes.

This edition is particularly suitable for:

• Customs Brokers Licensing Exam aspirants seeking a complete statutory reference

• Professionals in customs, logistics, and international trade requiring updated legal materials

• Compliance officers and corporate teams dealing with import–export operations

• Legal practitioners and consultants advising on customs and allied regulatory matters

• Students of law, taxation, and regulatory affairs looking for an accessible compendium of related laws