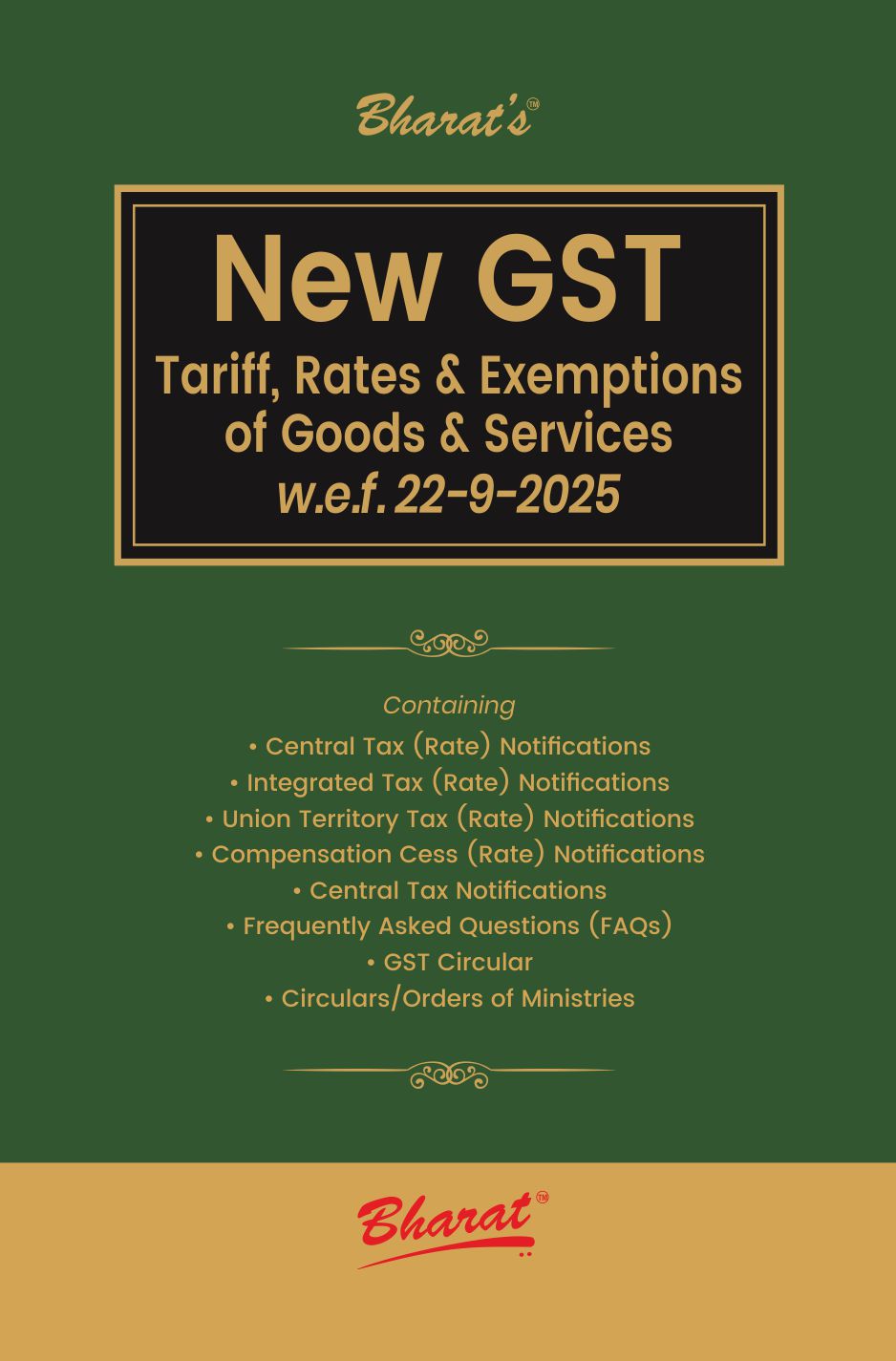

Bharat's New GST Tariff, Rates & Exemptions of Goods & Services

- Rs. 596

Rs. 795- Rs. 596

- Unit price

- per

Product Information

xFormat |

Printed Books |

Faculty Name |

Bharat Law House |

Course Material Language |

English |

Package Details |

1st Edition 2025, Paperback Book |

Sold & Dispatched By |

Bharat Law House |

Item Code |

978-81-1956-515-3 |

Study Material Format |

Printed Books |

Delivery |

Home Delivery within 7-10 days from the date of Payment Confirmation. |

Brand |

Bharat Law House |

No of Pages |

374 |

Description

x| About New GST Tariff, Rates & Exemptions of Goods & Services | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Division 1 56th Meeting of the GST Council: Press release, dated 3-9-2025 Division 2: Rates/Tariff Part A Central Tax (Rate) Notifications

Part B Integrated Tax (Rate) Notifications

Part C Union Territory Tax (Rate) Notifications

Part D Compensation Cess (Rate) Notifications

Part E Exempted Goods and Services

Part F Central Tax Notifications

|