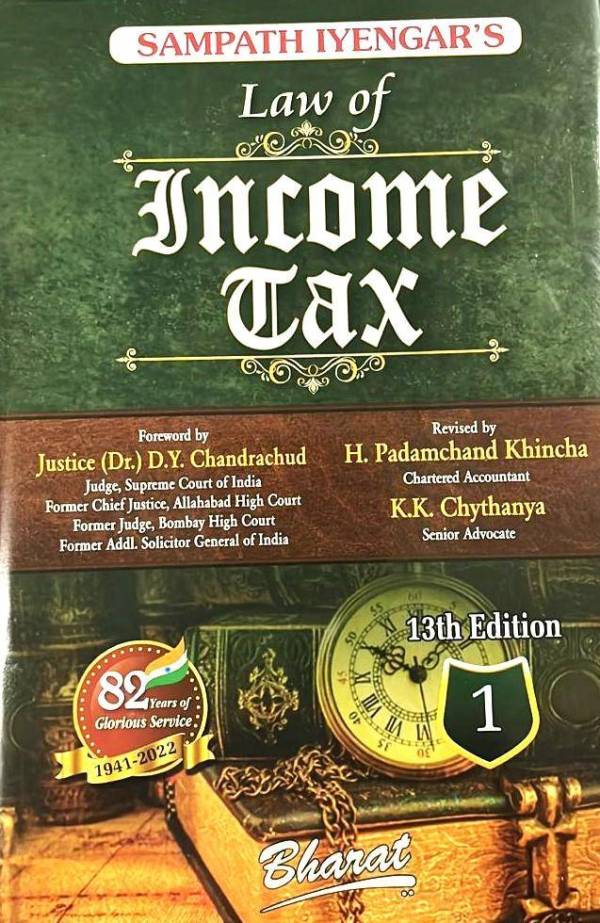

Bharat's Law of Income Tax (Volume 1) By Sampath Iyengar

- Rs. 2,097

Rs. 2,995- Rs. 2,097

- Unit price

- per

Product Information

xSubject |

Taxation |

Format |

Printed Books |

Faculty Name |

Sampath Iyengar |

Course Material Language |

English |

Package Details |

13th Edition 2022 |

Sold & Dispatched By |

Bharat Law House |

Item Code |

9789393749871 |

Study Material Format |

Printed Books |

Delivery |

Home Delivery within 7-10 days from the date of Payment Confirmation. |

Brand |

Bharat Law House |

Description

xSampath Iyengar’s Law of Income Tax has maintained its reputation as a commentary, exhaustive and encyclopaedic in its sweep, and as a veritable warehouse of all the available information on the subject, besides carrying critical and in-depth comments. It is the most authentic referencer, which has stood the test of time during the last eight decades and has retained its pristine glory. This set provides not only the necessary access to all the relevant information, but also the expertise and the experience of the authors, present and past. Conflicting views are highlighted. Precedents are not merely listed, but their rationale analysed. This book has always been different in not being content with mere listing of cases, but by providing enough material to tackle any problem that may arise. No wonder it is being referred and cited as an authority at all levels of judicial interpretation – Income-tax Department, ITAT, High Courts, Supreme Court and even Authority for Advance Rulings.

While India celebrates its 75 years of Independence, Sampath Iyengar has helped the professionals, tax administrators and the judiciary for the last over 80 years in finding solutions to their tax issues. No effort is spared in the present edition to maintain the reputation, which this book has gained in the field of income-tax law for the past eight decades and more.

This locus classicus has enjoyed the privilege of patronage from the profession of chartered accountants, tax practitioners, consultants, advisors, advocates, corporate executives, tax administrators and the judiciary.

Sections Covered

Volumes 1 to 3 – Section 1 to Section 32AD