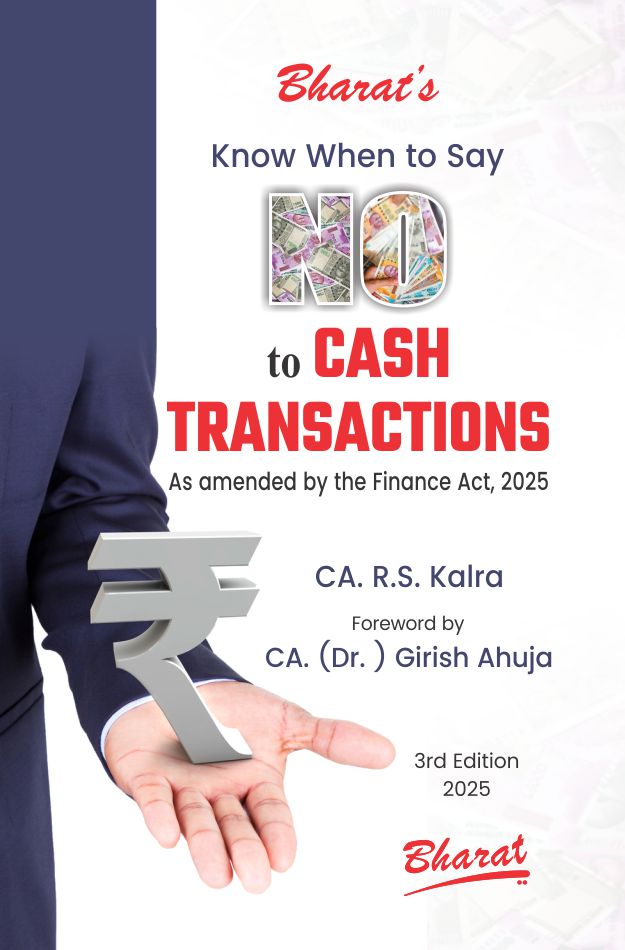

Bharat's Know When to Say No to Cash Transactions

All Products :

Bharat Law House

Brand : Bharat Law House

- Rs. 455

Rs. 650- Rs. 455

- Unit price

- per

Product Information

xFormat |

Printed Books |

Faculty Name |

CA. R.S. KALRA |

Course Material Language |

English |

Package Details |

3rd Edition 2025, Paperback Book |

Sold & Dispatched By |

Bharat Law House |

Item Code |

978-93-4808-037-0 |

Study Material Format |

Printed Books |

Delivery |

Home Delivery within 7-10 days from the date of Payment Confirmation. |

Brand |

Bharat Law House |

No of Pages |

248 |

Description

x| About Know When to Say No to Cash Transactions |

|

Chapter 1 Introduction

Chapter 2 Restrictions on Expenditure (Capital & Revenue)

Chapter 3 Incentives to Encourage Cashless Business Transactions

Chapter 4 Restrictions on Loans, Deposits & Advances

Chapter 5 Restrictions on Cash Transactions in Real Estate

Chapter 6 Disallowance of Income Tax Deductions

Chapter 7 Restrictions on Cash Transactions of `2 Lakhs or more

Chapter 8 Issues Arising on Account of Cash Deposited in bank - Demonetisation or Otherwise

Chapter 9 Concept of 'on money' during Search and Surveys

Chapter 10 Provisions of section 269SU

Chapter 11 Tax Deducted at Source Provisions on

Cash Transactions

Chapter 12 Cash Transactions in Agriculture Sector

Chapter 13 Cash Restrictions on Charitable Trusts

Chapter 14 High Value Cash Transactions

Chapter 15 Miscellaneous

|