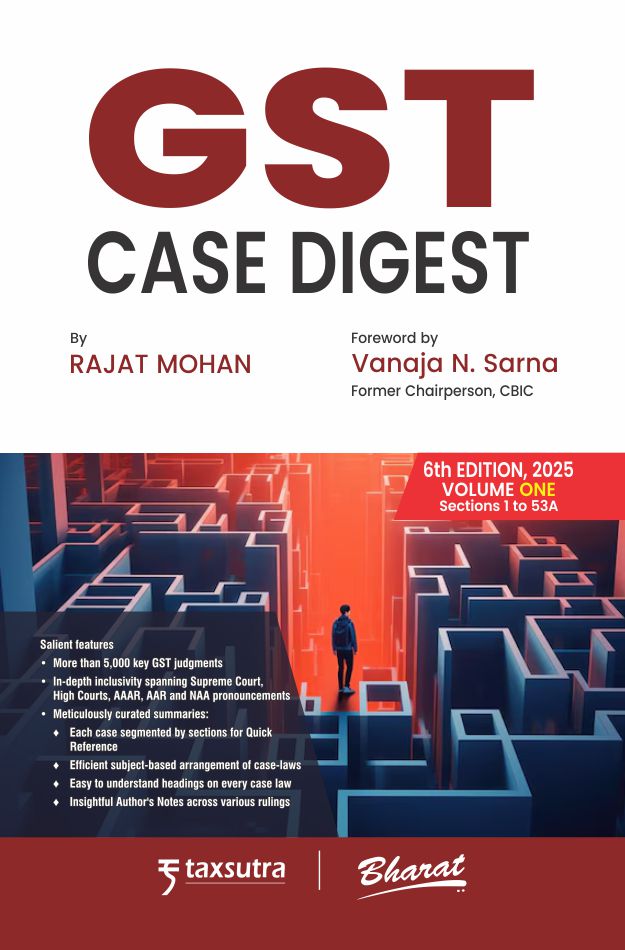

Bharats GST Case Digest (Set of 2 Volumes) Book by CA Rajat Mohan Foreword by Vanaja N Sarna

- Rs. 3,917

Rs. 5,595- Rs. 3,917

- Unit price

- per

Product Information

xFormat |

Printed Books |

Course Material Language |

English |

Package Details |

6th Edition 2025, Hardbound Book |

Item Code |

978-93-4808-079-0 |

Study Material Format |

Printed Books |

Delivery |

Home Delivery within 7-10 days from the date of Payment Confirmation. |

Brand |

Bharat Law House |

No of Pages |

3048 Pages |

Description

xBharats GST Case Digest (Set of 2 Volumes) Book by CA Rajat Mohan Foreword by Vanaja N Sarna

Chapter 1 - Preliminary

1. Short title, extent and commencement.

2. Definitions.

-actionable claim

-address of delivery

-address on record

-adjudicating authority

-agent

-aggregate turnover

-agriculturist

-Appellate Authority

-Appellate Tribunal

-appointed day

-assessment

-associated enterprises

-audit

-authorised bank

-authorised representative

-Board

-business

-capital goods

-casual taxable person

-central tax

-cess

-chartered accountant

-Commissioner

-Commissioner in the Board

-common portal

-common working days

-company secretary

-competent authority

-composite supply

-consideration

-continuous supply of goods

-continuous supply of services

-conveyance

-cost accountant

-Council

-credit note

-debit note

-deemed exports

-designated authority

-document

-drawback

-electronic cash ledger

-electronic commerce

-electronic commerce operator

-electronic credit ledger

-exempt supply

-existing law

-family

-fixed establishment

-Fund

-goods

-Government

-Goods and Services Tax (Compensation to States) Act

-goods and services tax practitioner

-India

-Integrated Goods and Services Tax Act

-integrated tax

-input

-input service

-Input Service Distributor

-input tax

-input tax credit

-intra-State supply of goods

-intra-State supply of services

-invoice or tax invoice

-inward supply

-job work

-local authority

-location of the recipient of services

-location of the supplier of services

-manufacture

-market value

-mixed supply

-money

-motor vehicle

-non-resident taxable person

-non-taxable supply

-non-taxable territory

-notification

-other territory

-output tax

-outward supply

-person

-place of business

-place of supply

-prescribed

-principal

-principal place of business

-principal supply

-proper officer

-quarter

-recipient

-registered person

-regulations

-removal

-return

-reverse charge

-Revisional Authority

-Schedule

-securities

-services

-State

-State tax

-supplier

-tax period

-taxable person

-taxable supply

-taxable territory

-telecommunication service

-the State Goods and Services Tax Act

-turnover in State or turnover in Union territory

-usual place of residence

-Union territory

-Union territory tax

-Union Territory Goods and Services Tax Act

-valid return

-voucher

-works contract

-words and expressions

Chapter 2 - Administration

3. Officers under this Act.

4. Appointment of officers.

5. Powers of officers.

6. Authorisation of officers of State tax or Union territory tax as proper officer in certain circumstances.

Chapter 3 - Levy and Collection of Tax

7. Scope of supply.

8. Tax liability on composite and mixed supplies.

9. Levy and collection.

10. Composition levy.

11. Power to grant exemption from tax.

Chapter 4 - Time and Value of Supply

12. Time of supply of goods.

13. Time of supply of services.

14. Change in rate of tax in respect of supply of goods or services.

15. Value of taxable supply.

Chapter 5 - Input Tax Credit

16. Eligibility and conditions for taking input tax credit.

17. Apportionment of credit and blocked credits.

18. Availability of credit in special circumstances.

19. Taking input tax credit in respect of inputs and capital goods sent for job-work.

20. Manner of distribution of credit by Input Service Distributor.

21. Manner of recovery of credit distributed in excess.

Chapter 6 - Registration

22. Persons liable for registration.

23. Persons not liable for registration.

24. Compulsory registration in certain cases.

25. Procedure for registration.

26. Deemed registration.

27. Special provisions relating to casual taxable person and non-resident taxable person.

28. Amendment of registration.

29. Cancellation or suspension of registration.

30. Revocation of cancellation of registration.

Chapter 7 - Tax Invoice, Credit and Debit Notes

31. Tax invoice.

31A. Facility of digital payment to recipient.

32. Prohibition of unauthorised collection of tax.

33. Amount of tax to be indicated in tax invoice and other documents.

34. Credit and debit notes.

Chapter 8 - Accounts and Records

35. Accounts and other records.

36. Period of retention of accounts.

Chapter 9 - Returns

37. Furnishing details of outward supplies.

38. Furnishing details of inward supplies.

39. Furnishing of returns.

40. First return.

41. Claim of input tax credit and provisional acceptance thereof.

42. Matching, reversal and reclaim of input tax credit.

43. Matching, reversal and reclaim of reduction in output tax liability.

43A. Procedure for furnishing return and availing input tax credit.

44. Annual return.

45. Final return.

46. Notice to return defaulters.

47. Levy of late fee.

48. Goods and services tax practitioners.

Chapter X Payment of Tax

49. Payment of tax, interest, penalty and other amounts.

49A. Utilisation of input tax credit subject to certain conditions.

49B. Order of utilisation of input tax credit.

50. Interest on delayed payment of tax.

51. Tax deduction at source.

52. Collection of tax at source.

53. Transfer of input tax credit.

53A. Transfer of certain amounts.

Chapter XI Refunds

54. Refund of tax.

55. Refund in certain cases.

56. Interest on delayed refunds.

57. Consumer Welfare Fund.

58. Utilisation of Fund.

Chapter XII Assessment

59. Self-assessment.

60. Provisional assessment.

61. Scrutiny of returns.

62. Assessment of non-filers of returns.

63. Assessment of unregistered persons.

64. Summary assessment in certain special cases.

Chapter XIII Audit

65. Audit by tax authorities;.br /> 66. Special audit.

Volume 2

Chapter XIV XIVI inspection, Search, Seizure and Ar

67. Power of inspection, search and seizure.

68. Inspection of goods in movement.

69. Power to arrest.

70. Power to summon persons to give evidence and produce documents.

71. Access to business premises.

72. Officers to assist proper officers.

Chapter XV Demands and Recovery

73. Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised for any reason other than fraud or any wilful misstatement or suppression of facts.

74. Determination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised by reason of fraud or any wilful misstatement or suppression of facts.

75. General provisions relating to determination of tax.

76. Tax collected but not paid to Government.

77. Tax wrongfully collected and paid to Central Government or State Government.

78. Initiation of recovery proceedings.

79. Recovery of tax.

80. Payment of tax and other amount in instalments.

81. Transfer of property to be void in certain cases.

82. Tax to be first charge on property.

83. Provisional attachment to protect revenue in certain cases.

84. Continuation and validation of certain recovery proceedings.

Chapter XVI Liability to Pay in Certain Cases

85 Liability in case of transfer of business.

86. Liability of agent and principal.

87. Liability in case of amalgamation or merger of companies.

88. Liability in case of company in liquidation.

89. Liability of directors of private company.

90. Liability of partners of firm to pay tax.

91. Liability of guardians, trustees, etc.

92. Liability of Court of Wards, etc.

93. Special provisions regarding liability to pay tax, interest or penalty in certain cases.

94. Liability in other cases.

Chapter XVII Advance Ruling

95. Definitions.

96. Authority for advance Ruling.

97. Application for advance ruling.

98. Procedure on receipt of application.

99. Appellate Authority for Advance Ruling.

100. Appeal to Appellate Authority.

101. Orders of Appellate Authority.

101A. Constitution of National Appellate Authority for Advance Ruling.

101B. Appeal to National Appellate Authority.

101C. Order of National Appellate Authority.

102. Rectification of advance ruling.

103. Applicability of advance ruling.

104. Advance ruling to be void in certain circumstances.

105. Powers of Authority, Appellate Authority and National Appellate Authority.

106. Procedure of Authority, Appellate Authority and National Appellate Authority.

Chapter XVIII Appeals and Revision

107. Appeals to Appellate Authority.

108. Powers of Revisional Authority.

109. Constitution of Appellate Tribunal and Benches thereof.

110. President and Members of Appellate Tribunal, their qualification, appointment, conditions of service, etc.

111. Procedure before Appellate Tribunal.

112. Appeals to Appellate Tribunal.

113. Orders of Appellate Tribunal.

114. Financial and administrative powers of President.

115. Interest on refund of amount paid for admission of appeal.

116. Appearance by authorised representative.

117. Appeal to High Court.

118. Appeal to Supreme Court.

119. Sums due to be paid notwithstanding appeal, etc.

120. Appeal not to be filed in certain cases.

121. Non appealable decisions and orders Chapter.

XIX Offences and Penalties

122. Penalty for certain offences.

123. Penalty for failure to furnish information return.

124. Fine for failure to furnish statistics.

125. General penalty.

126. General disciplines related to penalty.

127. Power to impose penalty in certain cases.

128. Power to waive penalty or fee or both.

129. Detention, seizure and release of goods and conveyances in transit.

130. Confiscation of goods or conveyances and levy of penalty.

131. Confiscation or penalty not to interfere with other punishments.

132. Punishment for certain offences.

133. Liability of officers and certain other persons.

134. Cognizance of offences.

135. Presumption of culpable mental state.

136. Relevancy of statements under certain circumstances.

137. Offences by companies.

138. Compounding of offences.

Chapter XX Transitional Provisions

139. Migration of existing taxpayers.

140. Transitional arrangements for input tax credit.

141. Transitional provisions relating to job work.

142. Miscellaneous transitional provisions.

Chapter XXI Miscellaneous

143. Job work procedure.

144. Presumption as to documents in certain cases.

145. Admissibility of micro films, facsimile copies of documents and computer print- outs as documents and as evidence.

146. Common Portal.

147. Deemed exports.

148. Special procedure for certain processes.

149. Goods and services tax compliance rating.

150. Obligation to furnish information return.

151. Power to collect statistics.

152. Bar on disclosure of information.

153. Taking assistance from an expert.

154. Power to take samples.

155. Burden of proof.

156. Persons deemed to be public servants.

157. Protection of action taken under this Act.

158. Disclosure of information by a public servant.