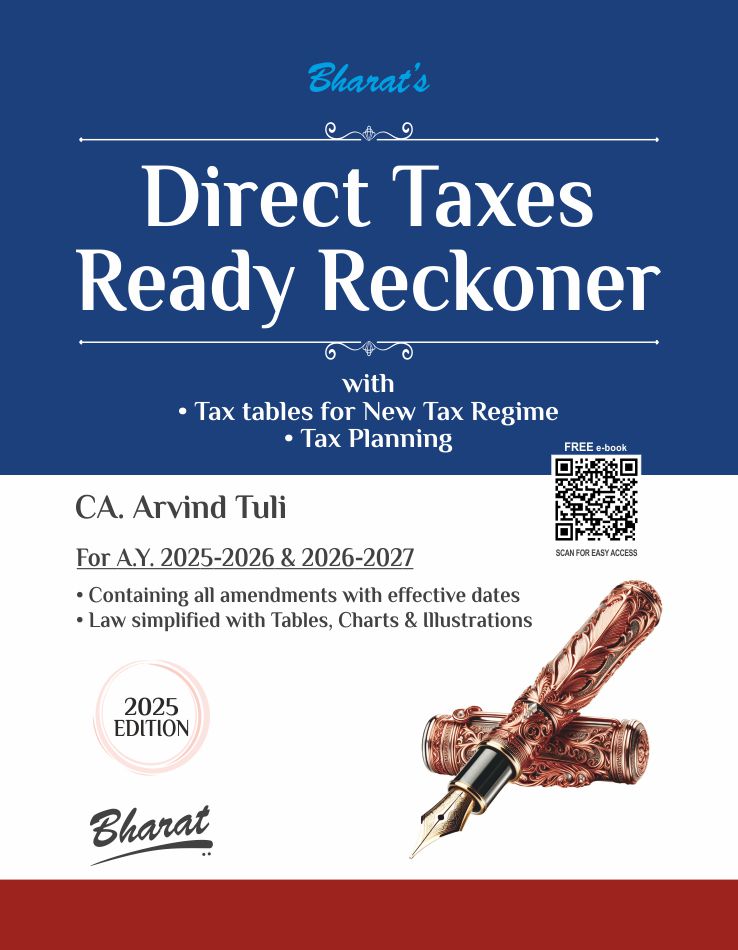

Bharat’s Direct Taxes Ready Reckoner by CA Arvind Tuli

- Rs. 1,607

Rs. 2,295- Rs. 1,607

- Unit price

- per

Product Information

xFormat |

Printed Books |

Faculty Name |

CA Arvind Tuli |

Course Material Language |

English |

Package Details |

2nd Edition 2025, Paperback Book |

Item Code |

978-81-1956-512-2 |

Study Material Format |

Printed Books |

Delivery |

Home Delivery within 7-10 days from the date of Payment Confirmation. |

Brand |

Bharat Law House |

No of Pages |

1008 |

Description

x| About DIRECT TAXES READY RECKONER |

|

QRN-1 Amendments of Finance Bill, 2025 explained in detail QRN-2 Computing tax for AY 2026-27 QRN-3 Rates of tax for AY 2025-26 QRN-4 Rates, Forms and dates of TDS & TCS QRN-5 Rates of Income Tax for Special incomes of Non-Resident QRN-6 Rates of Direct Tax for Last Ten Years QRN-7 Tax Obligations with Dates and Forms QRN-8 Reports and Certificates from an Accountant QRN-9 Depreciation Table Chapter 1 Introduction Chapter 2 Basis of Charge Chapter 3 Residential Status & Scope of Income Chapter 4 Exempted Incomes Chapter 5 Salary Chapter 6 House Property Chapter 7 Capital Gains Chapter 8 Business & Profession Chapter 9 Other Sources Chapter 10 Clubbing of Income Chapter 11 Dividend Income Chapter 12 Undisclosed Incomes Chapter 13 Gifts Chapter 14 Set off or carry forward & set off of losses Chapter 15 Deductions from GTI Chapter 17 Agricultural Income & Partial Integration Chapter 18 Assessment of Firms Chapter 19 Assessment of AOP & BOI Chapter 20 Assessment of HUF Chapter 21 Assessment of Political Parties & Electoral Trust Chapter 22 Assessment of Co-operative Societies Chapter 23 Tax Regimes Chapter 24 Assessment of Charitable Trust Chapter 25 Assessment of Companies Chapter 26 Returns of Income Chapter 27 Assessment Procedure Chapter 28 Appeals and Revision Chapter 29 TDS & TCS Part A – Tax Deducted at Source [TDS] Part B – Tax Collected at Source [TCS] Chapter 30 Tax Audit Chapter 31 Black Money Act Chapter 32 Assessment of Business Trusts Chapter 33 Penalties & Prosecution Chapter 34 Advance Tax & Interest Chapter 35 Refund, Recoveries and Reporting Chapter 36 Special Provisions for Banks & NBFC Chapter 37 Investment Fund, Securitisation Trust & Benefits to IFSC Chapter 38 Presumptive Incomes Chapter 39 Dividend Bonus Stripping Chapter 40 Business Re-organisation Chapter 41 Non-resident Taxation – Special Provisions Chapter 42 Board for Advance Rulings Chapter 43 Encouraging Digital Transactions |