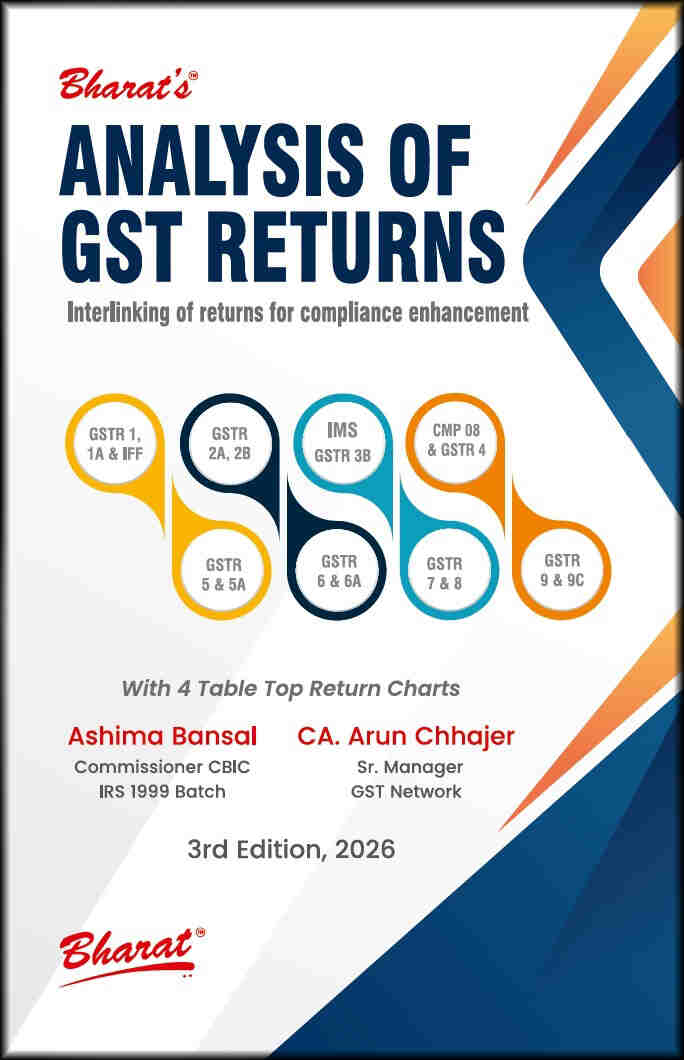

Bharat’s Analysis of GST Returns book by Ashima Bansal, CA Arjun Chajjer

- Rs. 900

Rs. 1,200- Rs. 900

- Unit price

- per

Product Information

xFormat |

Printed Books |

Faculty Name |

Ashima Bansal, CA Arjun Chajjer |

Course Material Language |

English |

Package Details |

3rd Edition 2025, Paperback Book |

Item Code |

978-93-4777-986-2 |

Study Material Format |

Printed Books |

Delivery |

Home Delivery within 7-10 days from the date of Payment Confirmation. |

Brand |

Bharat Law House |

No of Pages |

440 |

Description

x| About ANALYSIS OF GST RETURNS |

|

Chapter 1 Overview of GST Return Chapter 2 Analysis of GSTR 1 and its Interlinking with GSTR 3B, 9 and 9C Chapter 3 Analysis of GSTR-1A Chapter 4 Invoice Management System Chapter 5 GSTR 2A and GSTR 2B Chapter 6 GSTR 3B and its interlinking with GSTR 1/9/9C Chapter 7 Analysis of GSTR 9 and its Interlinking with GSTR 3B, 1 and 9C Chapter 8 Analysis of GSTR 9C and its interlinking with GSTR 1, 3B and 9 Chapter 9 CMP-08 and GSTR 4 [Composition Levy Scheme] Chapter 10 GSTR 5 (Non-Resident Taxpayer) Chapter 11 GSTR 5A (OIDAR and Online Money gaming) Chapter 12 GSTR 6 and 6A (Input Service Distributor) Chapter 13 GSTR 7 and GSTR 7A (Tax Deduction at Source) Chapter 14 GSTR 8 (TCS by ECO) |